Paying attention to interest can help you make the most out of what you earn. There are two main types of interest called simple and compound interest.

Simple interest is easier to calculate than compound interest as it’s based only on the money borrowed. Understanding the way this type of interest works will help you understand how it can make saving money easier.

What is Simple Interest?

Interest is basically the fee linked to money that’s invested, loaned, or borrowed. When that fee is fixed and applied only to the principal amount (borrowed or invested), it’s called simple interest.

Although it’s relevant for investing and saving, it’s the type of interest that you should look for when you need to borrow money. That’s because it keeps your debt from piling on as the interest accrued is only on the initial principal balance.

Simple interest is most commonly applied to short-term loans, such as personal loans, installment loans, car loans, and certain types of mortgages.

Usually, the first payment that you need to make on your simple interest covers the interest fee of the month. After that, your repayments start reducing the principal amount.

This type of interest can also change the way you make your investments and grow your money. The amount of money you make on simple interest is based only on the initial amount you invested.

Certificates of deposits or savings accounts with a simple interest structure earn you a specific amount of money and it won’t accumulate over time. You earn money in exchange for making your funds available for a financial institution, like a bank, to lend out to other people.

How to Calculate Simple Interest?

The following is the formula that you can use to calculate simple interest.

Simple Interest Amount = Initial Principal Balance (1 + (Annual Interest Rate) (Time in years))

Let’s say, you borrowed $1,000 from a bank to buy a refrigerator for your house with an interest rate of 5 percent for a period of five years. So, the simple interest amount that you’ll need to pay will be:

1,000 x 0.05 x 5 = 250

So, the total amount that you’ll need to pay to the bank will be:

1,000 + 250 = 1,250

It’s important to note that most financial institutes calculate simple interest on a daily basis. It means that if you pay your loan early, you’ll need to pay a less simple interest amount.

However, if you pay your monthly repayments late, then a larger portion of your payment will be applied to interest. As a result, the total loan payment will surpass the amount estimated at the start.

What is Compound Interest?

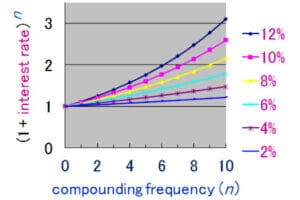

Compound interest is charged on both the principal balance and the accumulated interest. The amount of this type of interest is calculated with an annual percentage rate applied to the initial principal balance and the interest that has accumulated during the previous period.

That’s why it’s far more expensive as compared to simple interest and is commonly applied on credit card balances. When you’re investing or lending money, you should look for compound interest because it’ll help you earn more than simple interest.

So, How Can Simple Interest Make Saving Money Easier?

The following are some ways how simple interest can make it easy for you to save money.

Open a Savings Account

One of the easiest ways to save money using simple interest is to open a savings account in the bank and invest the spare money you have. It’s important to note that simple interest is calculated on a daily basis based on the closing amount of your account.

However, most banks add the accumulated interest to the account of the user yearly or half-yearly. It depends on the savings account type you have.

You can also use compound interest with your savings account to save money if you want. In fact, it’ll accumulate funds faster than simple interest and makes for a better option for investing.

Borrow Money Based on Simple Interest for Minimized Costs

If you need to borrow money from a bank, then going with simple interest will save you money as compared to borrowing money based on compound interest.

That’s because you’ll only need to pay interest on the initial principal balance and the accrued interest will not be included in the equation to calculate the interest amount.

As a result, you’ll need to pay less overall interest as compared to compound interest, which will save you money.

You can also borrow money based on simple interest to invest in a business. It’ll help potentially multiply the money that you borrowed and yield a higher sum by the time you have to pay it back. While this strategy involves high risk, it also has more potential to save more money.

Pay Off Your Loan Early

Paying off your simple interest loan earlier than what’s planned is another great way to save money. You can use the strategies listed below for this purpose.

Round-Up on Your Payments

Make a habit of rounding up your monthly payments even if you find it a little difficult. For example, if you need to pay $980 each month, consider paying $1,000 instead. The extra money that you pay will come directly off the initial principal amount that you owe to the bank.

It’ll automatically reduce your term and increase the chances of making early repayments and help you save money. Just simply round up to the nearest $100, or even $50. It won’t break the bank but help you a great deal in the long run.

Make Payments Weekly

Rather than sticking to the monthly repayment cycle against your simple interest loan, consider making weekly or even bi-weekly payments. It’ll allow you to pay more by the end of the month. This will help you pay off your debt early and will also help you save money.

When you wait until the month’s end to make your repayment, you may have already exceeded your budget or spent all of your available funds. This might result in you paying the bare minimum amount continuously when you could afford much more.

Reduce Your Expenses

If you want to save the most money possible by repaying your simple interest loan as soon as possible, then consider reducing your monthly expenses. Reassess your budget carefully and try to cut down on expenses where possible.

For example, you can cancel some of your online subscriptions and stop eating out for a few months. Make sure that you use the money you save by cutting down your expenses to make your loan payments.

This should significantly reduce the amount of time you need to pay off your loan, resulting in cheaper interest payments.

Final Words

Simple interest is an easy method for calculating the interest associated with a loan or investment. It is calculated using the initial principal balance, or the amount of money you committed to receive or repay at the start.

We hope this guide will help you understand how simple interest can help you make saving money easier. Use the methods discussed in this guide carefully to save money using simple interest.

Additionally, if you need to borrow money, consider utilizing simple interest as it costs you less than compound interest. Whereas, you should go with compound interest if you’re planning to invest, save, or lend money.